As a leader, keeping our teams safe and healthy is my biggest priority. Like many other companies, we have spent the past several weeks instituting processes that are designed to safeguard the health and well-being of our staff. At the same time, we are ensuring that we provide the service, support, and care that customers have come to expect from the Kasisto team.

We have also been focused on how Kasisto can support the financial services industry most effectively in dealing with the COVID-19 pandemic. The key question for us is how can AI-powered virtual assistants help banking customers around the globe in this time of crisis?

How Virtual Assistants Can Help Banks Manage the COVID-19 Crisis

A virtual assistant, considering this pandemic and the unprecedented market turmoil, presents a unique opportunity to help consumers as well as financial services organizations. With all the uncertainties this health crisis brings, one thing is clear: we are all anxious and stressed and want to know more about our financial vulnerabilities. Consumers around the world are asking their financial institutions questions about their financial future and overall financial well-being. And the more questions they ask, the more stress is put on the financial institutions’ bankers, call centers, and other front office staff.

Our goal is to provide customers with the critical information they need – quickly and efficiently – by leveraging our virtual assistants in a way that helps to reduce the stress that everyone is feeling. We feel a responsibility to give back by making our conversational AI technology available to help support our customers’ operational challenges and assist consumers with their questions about financial well-being.

Today we are analyzing millions of interactions and are building a new COVID-19 skill that will be available to our customers globally at no charge.

Here are some of the inquiries that we see in our data:

- How can I change my credit terms during this crisis?

- I am facing financial challenges due to COVID-19.

- I need help because my coronavirus trip had to be cancelled, does your travel insurance cover this?

- Are your branches open as usual?

- Can I get payment deferral for my mortgage and credit card due to the Coronavirus?

- Do you provide health insurance for COVID-19?

Training virtual assistants to handle these types of questions requires time and data. Our Digital Experience Platform KAI has virtual assistants that are trained in the language of finance and banking using conversational data from millions of consumers around the world which makes them some of the most intelligent and well trained in the industry. This also means we can add new skills, intents, and conversational capabilities rapidly to respond to the current COVID-19 and financial crises – precisely what is required to prevent customers from experiencing excessive and frustrating hold times to speak with someone.

We also work with our customers to use best practices in deploying virtual assistants to increase their utilization and effectiveness. Here are some of the key lessons learned from deploying virtual assistants at major financial institutions around the world:

- Increasing awareness through targeted marketing campaigns to educate users on virtual assistant specific features and capabilities to improve their discover-abilities.

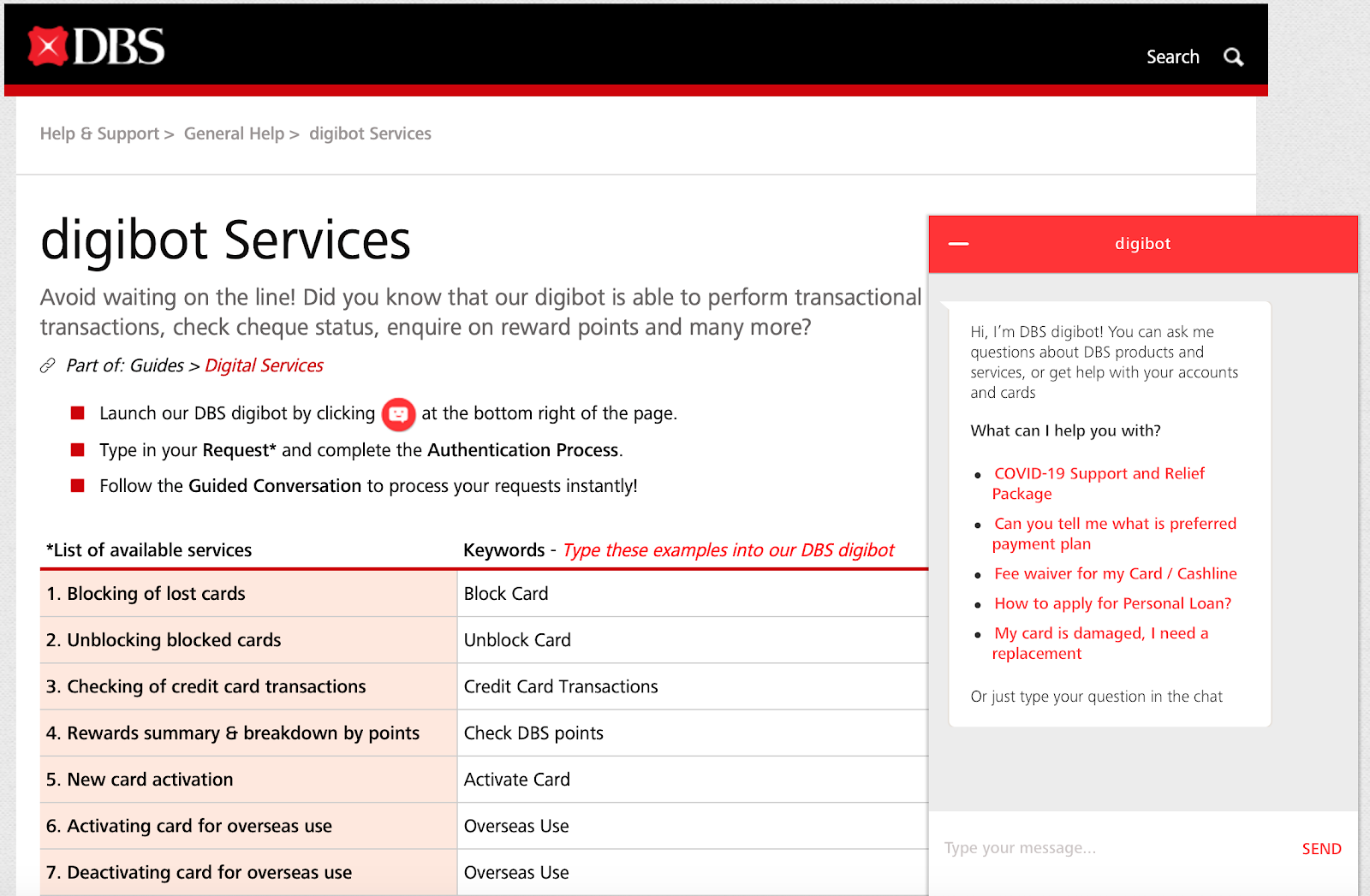

- One of our customers, DBS, who has been named The Best Bank of the World, is a leader in using conversational AI to help its customers get quick access to many of their banking services through the DBS digibot virtual assistant powered by KAI. DBS actively promotes these capabilities across its digital properties.

- Guiding users directly to virtual assistants instead of calling call centers when they perform Google searches. In other words, instead of calling a bank and waiting on hold, users engage with a virtual assistant instead. This is similar to a Chat Suggest feature implemented within Apple Business Chat.

- Continuously analyzing interaction transcripts of new requests as well as top queries handed over to human agents and rapidly retrain your virtual assistants

- Improving coverage by adding time-critical skills (i.e. COVID-19 challenges described above)

KAI is Ready to Support Your Financial Institution

Using conversational AI to help people to better understand and manage their finances has always been our mission at Kasisto, and at a time like this, when the world is locking down to defeat the virus, we can use technology to help people get answers to questions that impact their financial and personal well-being, all while helping our banking customers deal with the stress that this crisis is having on their call center operations. We hope that our new COVID-19 skill can support our customers to help people deal with their financial questions, pressures and stress during this unprecedented time.

To learn more about how Kasisto developed our COVID-19 skill and the data that drove our analysis of this critical customer need, click here.

If you have any questions or feedback, please feel free to contact me directly at zor@kasisto.com.

Best regards,

Zor