Our Products

Visit our Products page to see how we can help your global financial institution or regional bank.

Some of the world’s largest financial institutions turn to Kasisto to automate amazing banking experiences, achieve business objectives, and drive growth.

The debut of ChatGPT has brought endless predictions and promises about how generative AI will transform industries of all shapes and sizes – including banking.

Kasisto helps you keep up with the generative AI conversation and realize real results by making it part of your customer and employee experience strategy – while remaining ever-mindful of the unique needs of a regulated and community-focused industry that banks on consumer trust.

Countries

Continents

Financial Institutions

Consumers with access to KAI

Reduction in Live Chats

With Kasisto, you don’t have to understand the ins and outs of generative AI or navigate its capabilities on your own.

We provide expert guidance rooted in real experience to help you adapt, respond, and grow your business in the new age of banking.

Facilitate highly personalized customer experiences that enhance engagement and retention, arm your employees with deep intelligence, and outsmart the competition – all by introducing generative AI-powered employees to your best banking teams.

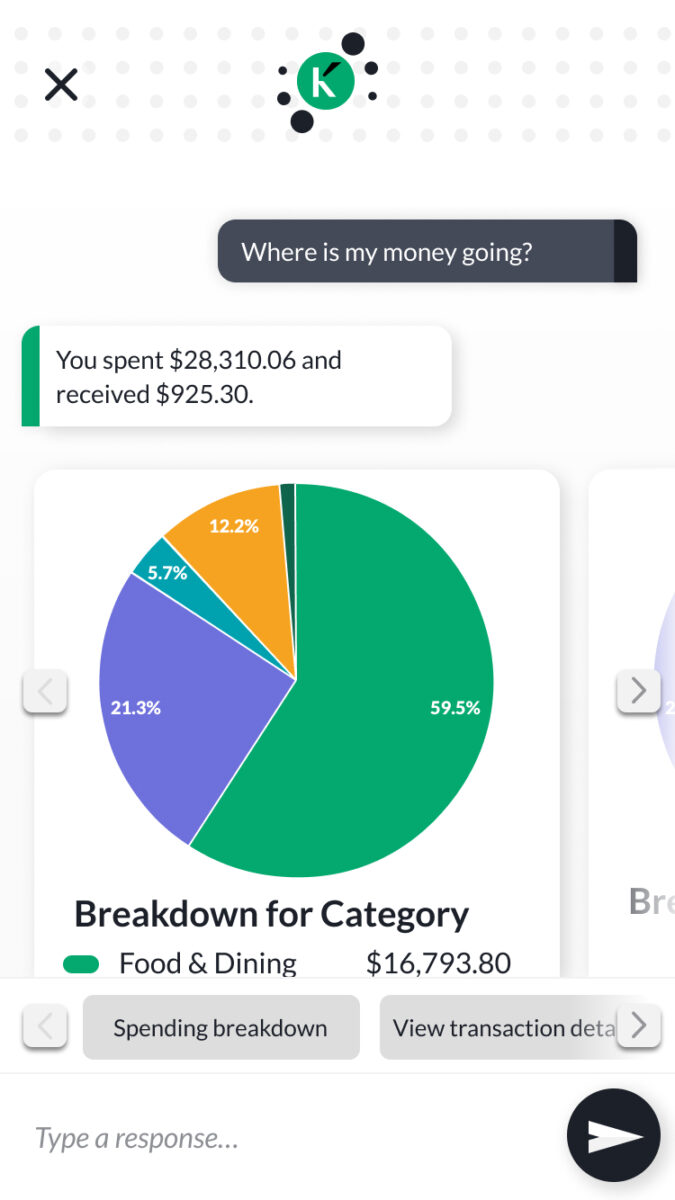

KAI, our conversational AI platform, provides the essential infrastructure to deploy consistently amazing experiences across your channels, supporting a set of applications tightly integrated with your banking ecosystem.

The financial industry’s large language model (LLM) tailors the power of KAI for the specific needs of your customers and employees.

Our Portal acts as an accessible and convenient interface for your entire experience within the KAI Platform.

This application leverages KAI-GPT to deliver comprehensive responses to detailed inquiries from customers and employees with unmatched precision.

Our intelligent digital assistants act as the face of your institution, embodying your brand and leveraging generative AI to deliver personal, agile, and humanizing experiences. These solutions include:

Visit our Products page to see how we can help your global financial institution or regional bank.