Access KAI via Your Digital Banking Provider

Community banks and credit unions can enjoy the same high-quality, personalized digital assistants offered by the world’s largest financial institutions, but at a fraction of the cost, with no coding and negligible upkeep required.

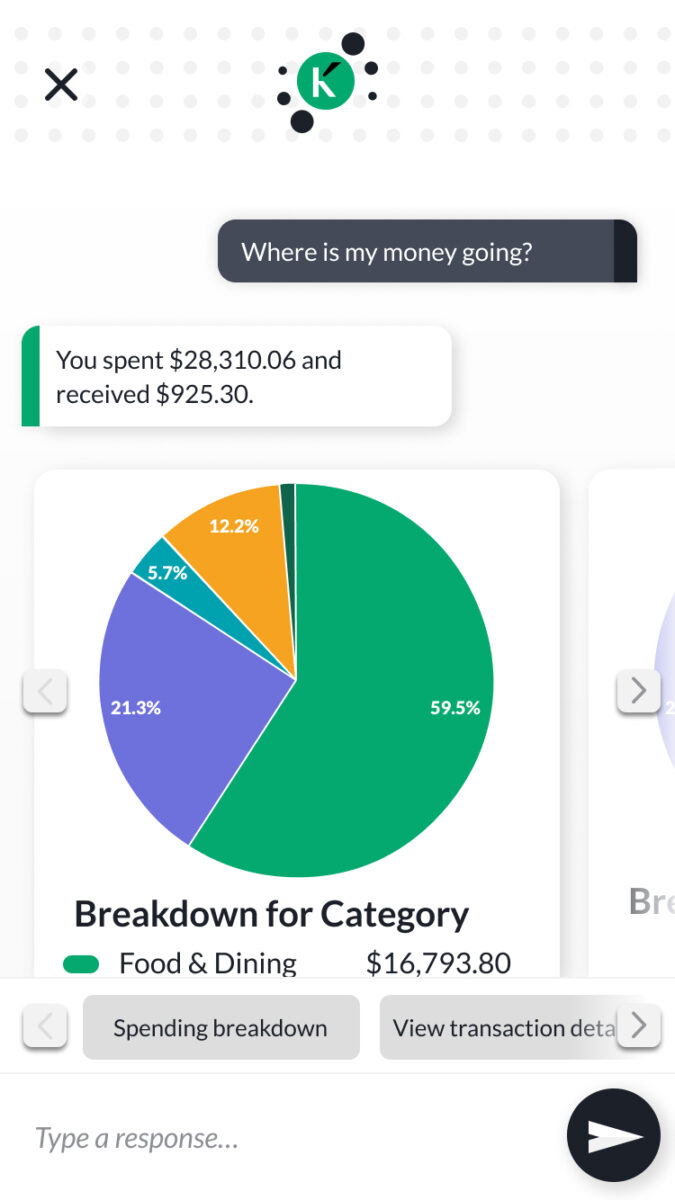

The KAI platform comes pre-integrated with top digital banking partners like NCR, FIS, and Q2. This provides a unique, tailored, and frictionless banking experience across channels. Our integrations ensure that your financial data is always up to date, allowing you to make informed decisions instantly.