On Tuesday, we ushered Kai into the world. Kai is the smart bot inside MyKAI. We built MyKAI to give anyone a taste of the future of banking on messaging apps.

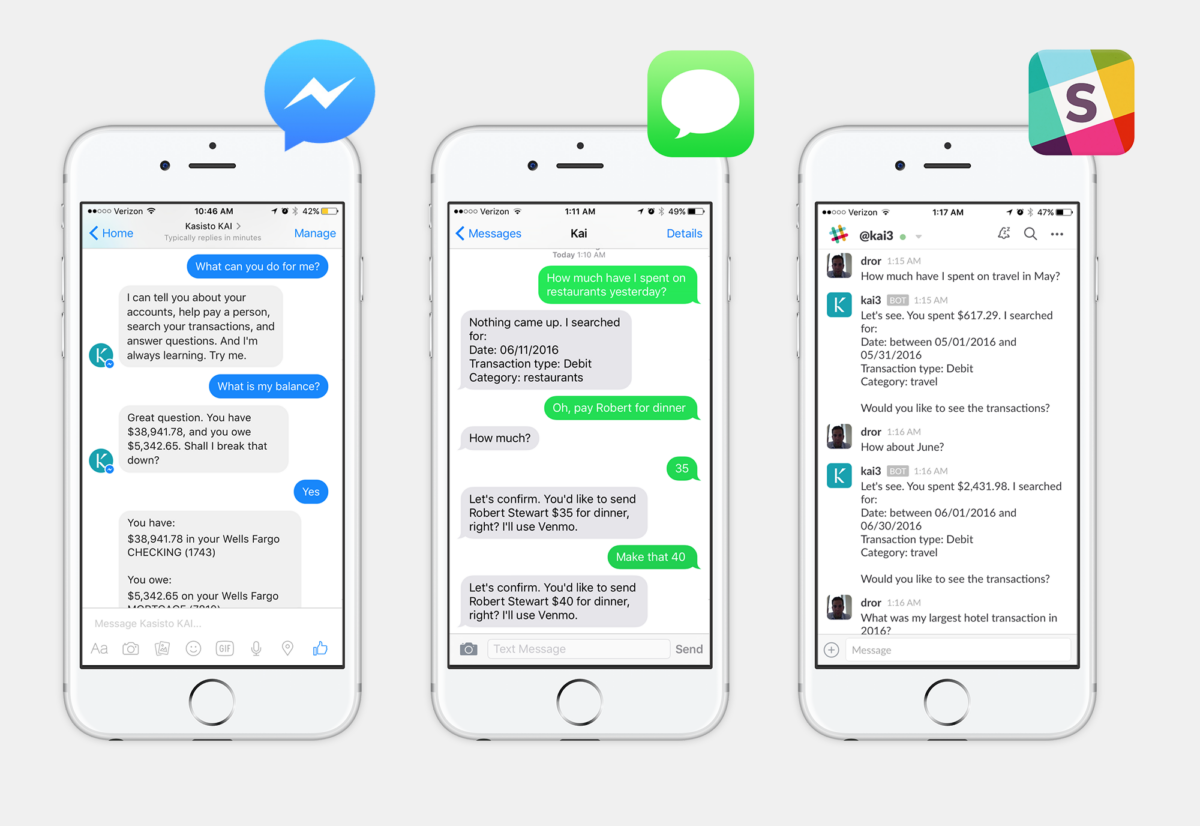

Kai helps you manage money, track expenses, and make payments, all from within your favorite messaging — Facebook Messenger, SMS, or Slack. Kai is not your average bot because it understands and produces conversational language naturally, and knows banking inside and out. You just type to Kai as you would to a friend, no prompts required. And, as you chat, Kai gets smarter, learning from your conversations eagerly.

You can see all of your accounts in one place, including saving, checking, credit cards, loans, and more. That’s because Kai knows 20,000 US banks. With your Venmo account connected, you can even make payments. It’s as secure as a bank’s mobile app, and you can read more about that at Security.

I should mention that Kai cannot make payments or transfer money from your bank accounts. For that, it needs to be integrated with your bank. As banks begin to integrate our technology, Kai will allow you to securely grant access to transfer money between accounts and make payments from them.

Also, Kai responds in raw text form. We chose this format to showcase the power of pure conversation. In the future, MyKAI will have a richer interface, but in the meantime, interacting with Kai feels just like texting a friend.

Lastly, we put a tremendous amount of time and thought into Kai’s voice and personality. Kai possesses a unique personality with a dry sense of humor that’s not too cute – it’s helpful and efficient, yet personable. There are few things more serious than your money, and Kai has a sense of responsibility and is ready with resources and plain-English glossaries to help you manage your money.

I invite you to sign up for MyKAI and chat with Kai today. Experience banking on messaging, and here’s just a sampling of what you can do.

Check balances

With all of your accounts in one place, you can ask Kai anything about balances. What’s my balance? How much money do I have in checking? What’s the current balance on my cc? How much do I owe on all my credit cards? What’s my available credit on my Visa? How much money do I have in all of my accounts?

Categorize your spending

Kai knows expense categories to tell you summaries or breakdowns. How much did I spend on restaurants in May? How about travel? How much did I spend on groceries last week? How much did I spend on gas last month? How much have I spent on junk food in 2016?

Track what you spend someplace

Kai understands how you spend your money and tracks expenses by merchant. How much did I spend on Uber last week? Last month? How much did I spend at Apple last year? How much have I spent at Philz Coffee? What was my largest Best Buy transaction?

Track when you spend

Kai can give you summaries and breakdowns for specific days or ranges. How much did I spend on June 2? How much did I deposit in April? How much did I spend on Visa cc last week? How much did I spend last weekend? How much have I spent in 2016?

Track how much you spend

Kai knows least, largest, and more. Show my last 5 checks. Show my largest transaction in May. What was my largest hotel transaction in 2015? What was my most expensive restaurant expense?

Pay with Venmo

If you have a Venmo account, Kai can help you pay people. Pay Lauren $15 for pho. I’d like to send Sasha $20 for lunch. How much did I pay Andy last week? How much did I pay Andy last week? Pay Cleo for rent.

Get definitions

Kai knows 1,057 banking terms and counting. It can help you bank better. What is the Fair Credit Billing Act? What is APR? What is compound interest? How is a credit score defined? Define FHA. What does garnishment mean for me?