“Pre-pandemic, people might have thought we were automating too much. This event is going to push people to think what more should be automated.”, Robots Welcome to Take Over, as Pandemic Accelerates Automation, New York Times April 10, 2020

As the world continues to shift, driven by a global pandemic, how we communicate with each other and how we interact with businesses are changing. Every business across every industry is navigating new ways to interact with its customers while keeping essential services running as smoothly as possible. The financial services industry is no exception.

The financial institutions that we work with have comprehensive Digital Transformation and Business Continuity Planning (BCP) strategies that they activate during a crisis. This blog is focused on raising questions about industry preparedness, sharing our experiences, best practices, and learnings as the industry has used our virtual assistants (chatbots) over the past several months of the COVID-19 pandemic.

Business Disruption in the Financial Industry Post COVID-19

Within the financial services industry specifically, the disruption to business as usual is staggering: 82% of consumers are concerned with visiting a branch*, using an ATM or even interacting with a teller at a drive through, often forcing customers to rely on call centers which are being overwhelmed with customer inquiries that now often have average wait times exceeding 2 plus hours**.

You would think these wait times are being driven by anxious customers inquiring about their finances. Although this is certainly true, the other less known fact is that availability of call center agents is down due to global lockdowns in countries with outsourced call centers as well as staff absenteeism related to the COVID-19 outbreak. Anyone who has visited a call center knows that they are not designed for social distancing. Because of this, here is the new normal — a typical bank website notification these days:

COVID-19: We’re experiencing high telephone call volumes – we appreciate your patience. For faster account management, use our Mobile App. You can also text “App” and we’ll send you a link to our digital app. See the latest info on how to request account assistance, find branch availability and more.

On the commercial banking side of the industry, things are not much different. With small businesses across America under enormous stress, the recent federal stimulus package has provided much needed capital to the Small Business Administration (SBA). These loans are designed to help small businesses keep staff on payroll and meet other operational expenses. Yet, the federally assisted program lacks details and is also complex. Small businesses around the country are inundating participating SBA banks with questions related to PPP (Payroll Protection Program) and EIDL (Economic Injury Disaster Loss) assistance. Due to this volume, some banks have stopped taking calls related to the SBA, while others have limited their traditional loan programs in order to service SBA-related loan applications.

So what can we all learn from this?

- In a time of crisis, people have more questions than usual, and these questions are more urgent.

- Human-centric operating models, such as a call center, break down in a pandemic, because call centers are not designed to handle tremendous spikes in service levels, especially when critical call center agents are also quarantined during the pandemic.

- Digital channels need to be nimble, intelligent and responsive, rapidly adapting to the needs of the customer.

Financial Consumer Behavior During COVID-19

Prior to the COVID-19 crisis, users of Kasisto’s KAI, across our banking customers asked typical questions about their finances, including information about their accounts (balances, payments, due dates), searching and inspecting their transactions, etc. KAI was also used to explore new financial products, service credit cards and understand spending patterns. KAI has proven very effective in handling these kinds of requests with containment rates in excess of 85% across all of our customers.

With the outbreak of COVID-19, customers have quickly changed how they interact with our virtual assistants. Service-related questions are up. In fact, from February to March alone we saw a 14% growth in user inquiries. And in April the volume doubled again as we’ve already seen a 29% increase in user inquiries over March. Questions are directly related to financial and personal wellness, examples such as:

- Where am I spending my money?

- When are my payments due?

- Can I defer my monthly payments?

- How often are local ATMs cleaned?

All perfectly normal questions under the circumstances, but it underscores the need for a virtual assistant to scale up to handle much higher volumes in terms of question coverage (when was the last time someone asked how frequently ATM’s are cleaned and how safe they are to use)?

There are several factors driving the increased activity. Specifically we observed a 66% increase in money transfers and remittances, 24% increase in users asking for assistance to enable digital banking services, and an 18% increase in requests related to payment relief. At the same time, requests to open new accounts or speak to a banker decreased by 23% and 17% respectively. In all of this, KAI proved to be a scalable virtual assistant, handling considerable increases in customer service demand.

Digital Channels are Critical in Finance During COVID-19

What does this mean overall? In a time of crisis, people want to understand what their financial wellness is, where they might be financially vulnerable, make more digital payments, and are far less interested in new banking services or additional financial products. In summary, customers find the most helpful digital channel (in this case, KAI powered virtual assistants) and continually use it for their important inquiries and needs.

One of our customers recently said “Virtual Assistants and chatbots are a must have for us during these days with the challenge on our capacities. Our volumes have shot up and without this digital engagement channel, we would not be able to meet the needs of customers during this very trying time”

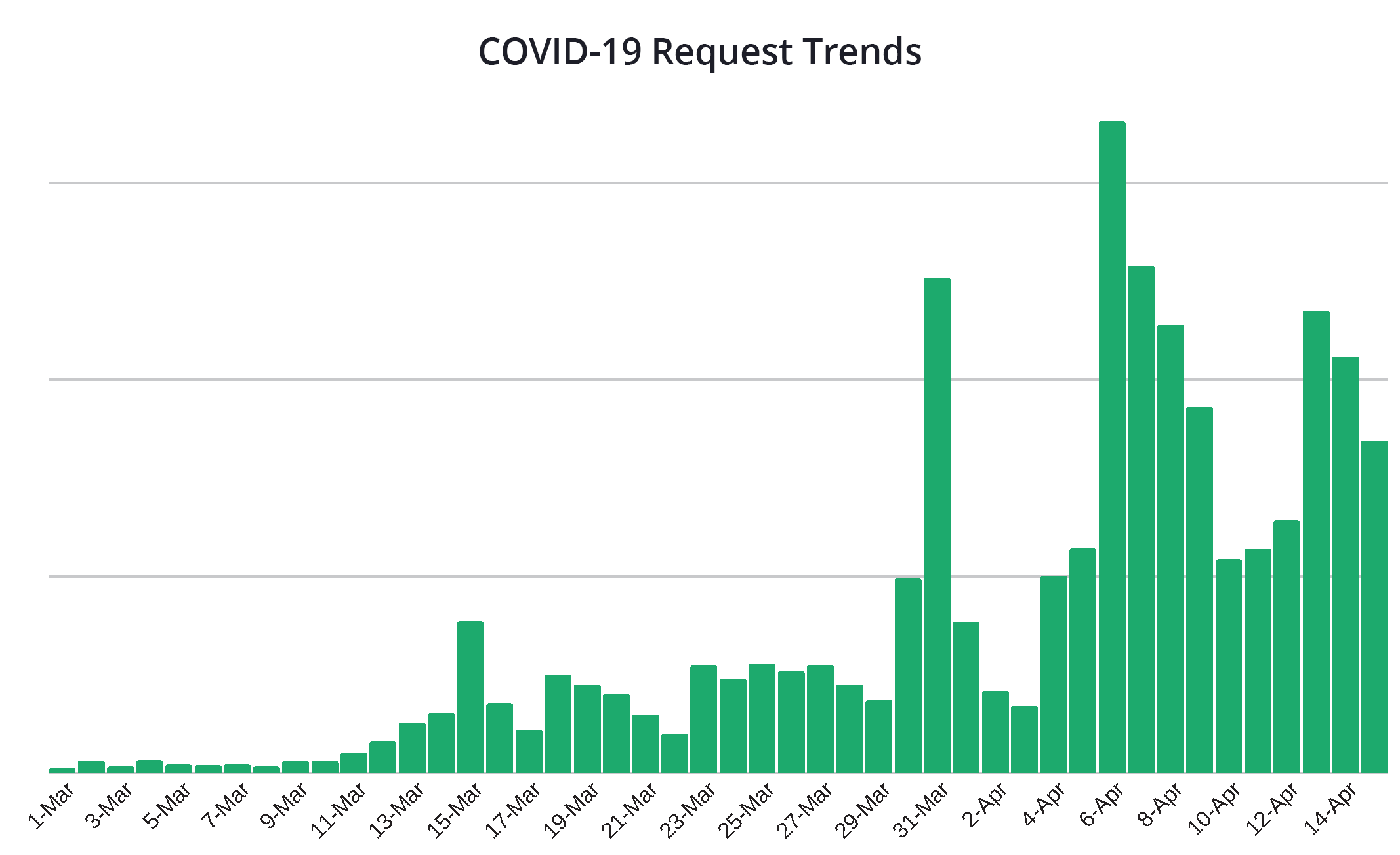

And of course, questions related to COVID-19 and banking are being asked by customers all across our global install base. The graph below shows the daily spike in requests as the virus and crisis progressed. Early in March you can see that the COVID-19 related requests were low but then as coronavirus became a pandemic, requests skyrocketed going into April and remain high.

This is why we quickly rolled out our COVID-19 skill described below:

KAI COVID-19 Skill Features

- General Inquiries – generic request about the coronavirus

- Interest Rates – customers ask for relief via lower interest rates on loans, mortgages or credit cards

- Payment Deferral – customers ask for lenience/relief by allowing for deferred payment from loans, mortgages or credit cards

- Branch Hours/Safety – customers ask if branches are open and how the branches may be impacted by the coronavirus

- Travel Insurance – users looking to either leverage their insurance to cancel their travels due to COVID-19 situation, or sometimes to cancel the Travel insurance itself

- Health Insurance – customers are requesting information about the COVID-19 health coverage

Because of KAI’s deep banking knowledge and these new capabilities, our customers have increased the usage of our platform across their customer base, in consumer and business banking. All with one objective in mind: in a time of distress, our customers want to service their customers quickly and efficiently, without subjecting them to long call center hold times or hard to navigate web portals. By getting this right, as they have, our customers are generating a meaningful step change in the relationship between them and their customers, especially during this time of crisis.

COVID-19 and the “New Normal” in Banking

It’s important to remember this is only the first wave of interactions, and as COVID continues and the “new normal” gets established, questions and conversations will continue to evolve and become even more complex.

Having a virtual assistant that is trained on tens of millions of utterances and has deep banking knowledge is an essential ingredient to its ability to rapidly support the addition of new skills. Any financial institution that has this virtual assistant (chatbot) deployed must be able to offer exceptional service to their customers, while reducing demand on their already overstressed banking workforce. In addition, it has become abundantly clear that virtual assistants must become an essential ingredient in every bank’s Business Continuity Planning (BCP) infrastructure.

So back to the question whether the financial services industry is prepared for the new normal. The data would suggest that overall, it is not. With customers experiencing long call center wait times that rely on a workforce that can decrease in productivity during a health crisis, banks are not ready to deal with massive swings in customer inquiries. It’s also clear that current digital servicing strategies are siloed and do not take advantage of AI to help automate customer service needs, which forces customers back to the call center. In both cases, the customer is left underserved, and the bank is left overwhelmed.

As part of the new normal, customers will demand access to information more quickly, with less friction and complication without having to wait hours on a call. At the same time, digital capabilities should support an efficient way of banking that reinforces personal and financial well-being, and that helps to get the world back to work. At the center of this response is the need for a digital strategy that includes omni-channel (web, mobile, chat, messaging, phone) virtual assistants that respond quickly and intelligently, and are able to provide a consistent response and user experience. This same digital strategy needs to be proactive and look for new clusters of questions that arise as the crisis evolves and quickly adapts to meet these needs, while providing relief to overworked banking staff and call center agents.

I’ll be talking more about all of this, and will be getting into the underlying data with our colleagues at Forrester in our upcoming webinar, The Virtual Assistant in a Times of Crisis. Please feel free to register here.

Zor

* Lightico, Customer Survey: Impact of COVID-19 on Consumer Banking

** Bloomberg, Three Hours on Hold? Banks Inundated with Nervous Callers