“What I’ll say is the broad but shallow and the deep but narrow approaches are actually working towards the same goal because neither are an end into themselves. “ Ian Jacobs, Forrester; The Intelligent Virtual Assistant: Myth or Reality? Webinar August 2019.

How to Choose the Right Deployment Strategy and Conversational AI Provider

It’s not lost on the financial industry that customers’ expectations around customer service and the channels they want to use to interact with their banks are changing. You can’t go one news cycle without seeing headlines like “The Changing Customer Experience” or “Winning over the Digital Customer”. The sense of urgency to be able to engage the “digital customer” has firms assessing their digital experience strategies — do we go broad and shallow or narrow and deep?

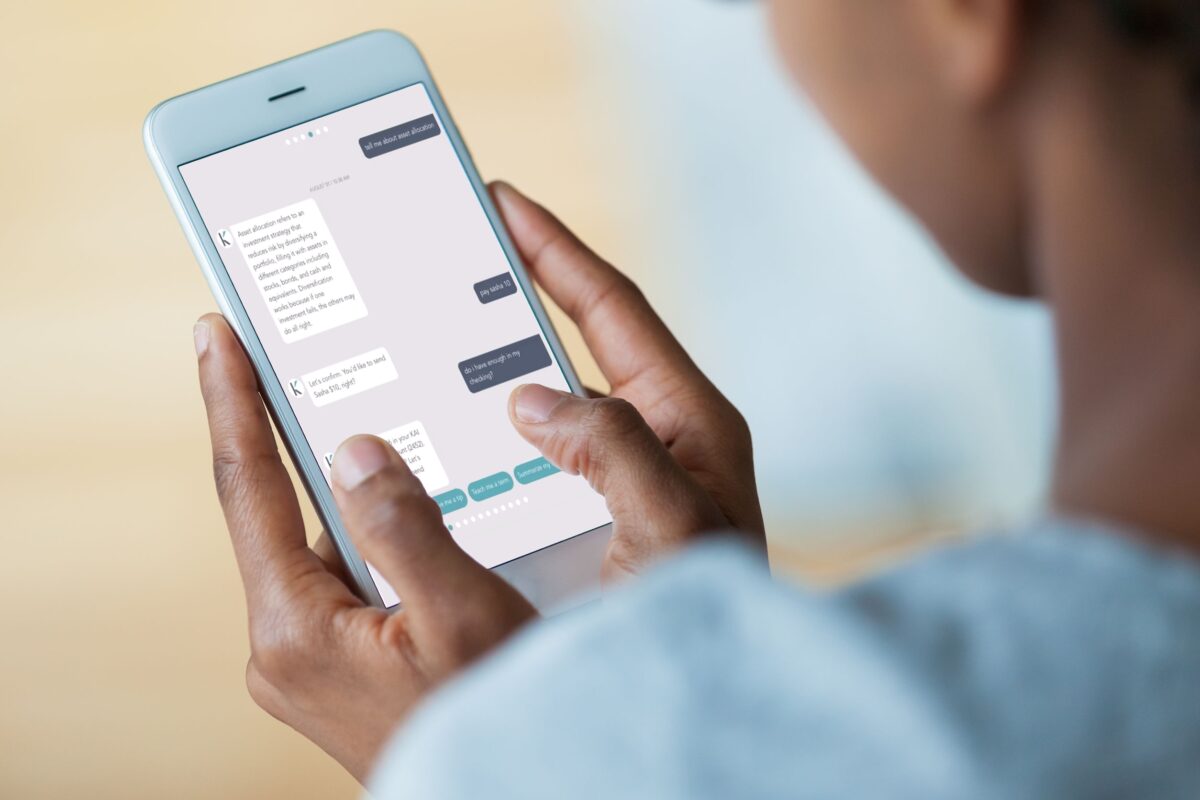

Virtual assistants (VA) have proven they are capable of doing amazing things. They can produce fantastic customer experiences with their ability to provide information and knowledge almost instantaneously. But, a successful virtual assistant is the result of a successful deployment strategy and the right Conversational AI provider. Let’s discuss the different deployment approaches to virtual assistants we see in the market, how both strategies lead to the same place, and why the right partner is crucial to success.

Broad but Shallow

When many firms set out on the path of implementing a virtual assistant, they start with the idea that the knowledge of the VA doesn’t need to go very deep, that it only needs to be able to answer their top 20 FAQs and provide basic account information/management. Firms realize as their customers are interacting with their VA, they want more. More times than not, a VA that has wide and shallow knowledge will need to hand off the conversation to a human. For example, when they ask about their account balance, they might want to know how much they spent in a certain category; if the VA is only set up to answer basic FAQs this will require the conversation to be handed over to a live agent or the information will need to be provided outside of the conversation via email or some other form. This approach eventually leads to the need of deepening the VA’s knowledge.

Deep but Narrow

If the firm decides to go the narrow and deep route, they often focus on one topic like financial health management. The VA can provide answers to questions about savings goals, credit card limits, setting spending alerts, and more. But, the customers are still going to ask the questions about basic banking functions and payment capability, which the VA can provide, it’s just that those answers will remain at the intelligence level of wide and shallow since they went narrow and deep on one topic. Once that topic is nailed down, the firm will move on to the next, thus deepening the VA’s knowledge on multiple topics.

Choosing the Right Partner

As these firms assess the opportunity to improve customer’s digital experiences, they need a Conversational AI platform that is built on more than a generic conversational framework. There is a big difference between rudimentary, single-purpose chatbots versus AI-powered virtual assistants that come with pre-packaged banking knowledge and can anticipate customer needs based on context. Kasisto’s KAI is the leading Digital Experience platform that is designed to master the language of finance.

KAI can help firms on their journey, whichever path they choose.