KAIgentic is your safe path forward.

- The urgency to adopt AI is real.

- The risk of getting it wrong is greater.

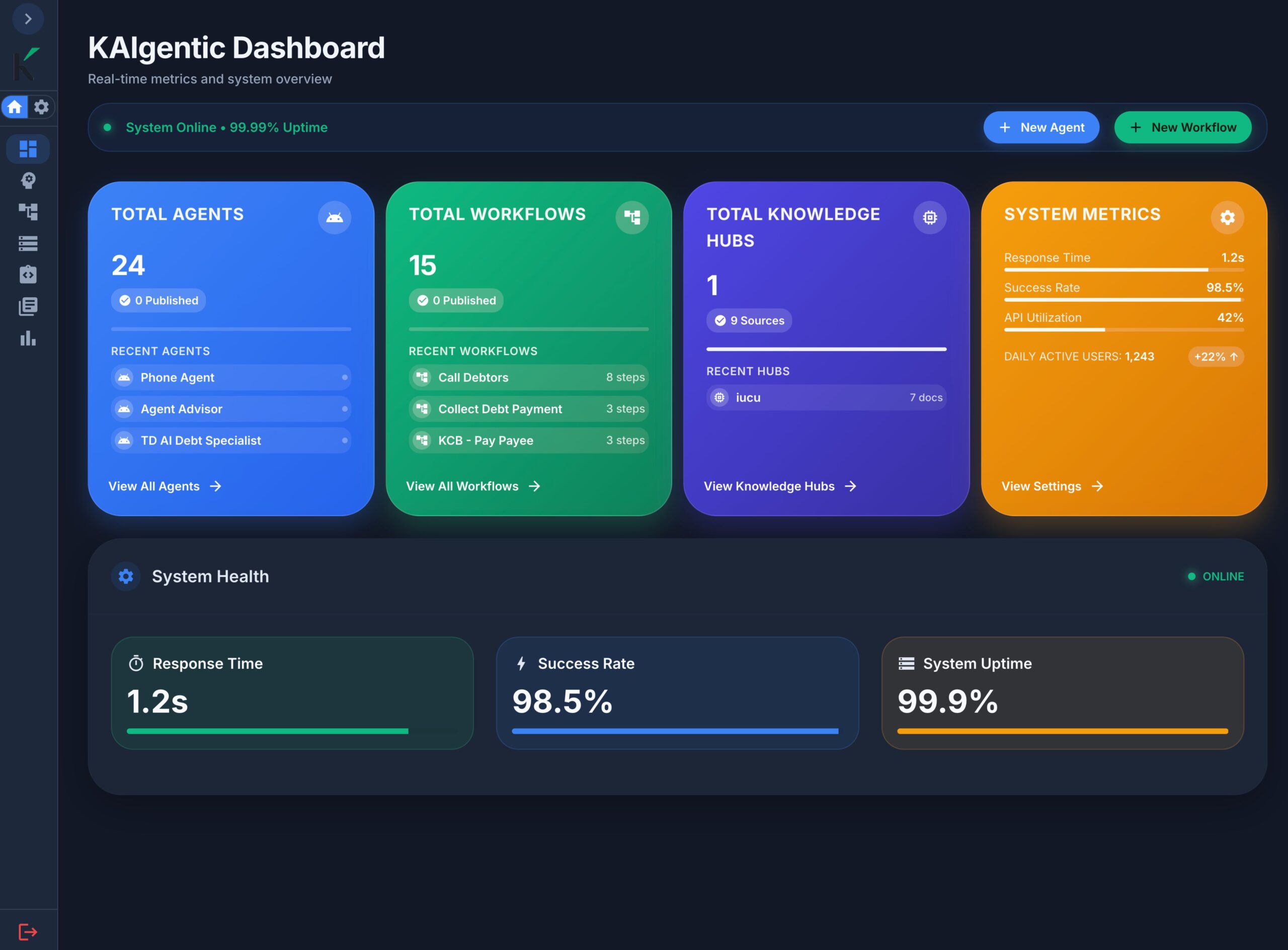

KAIgentic is the first agentic AI platform purpose built for financial institutions. It orchestrates intelligent autonomous agents that understand your customers, respect your policies, and deliver outcomes you can trust.

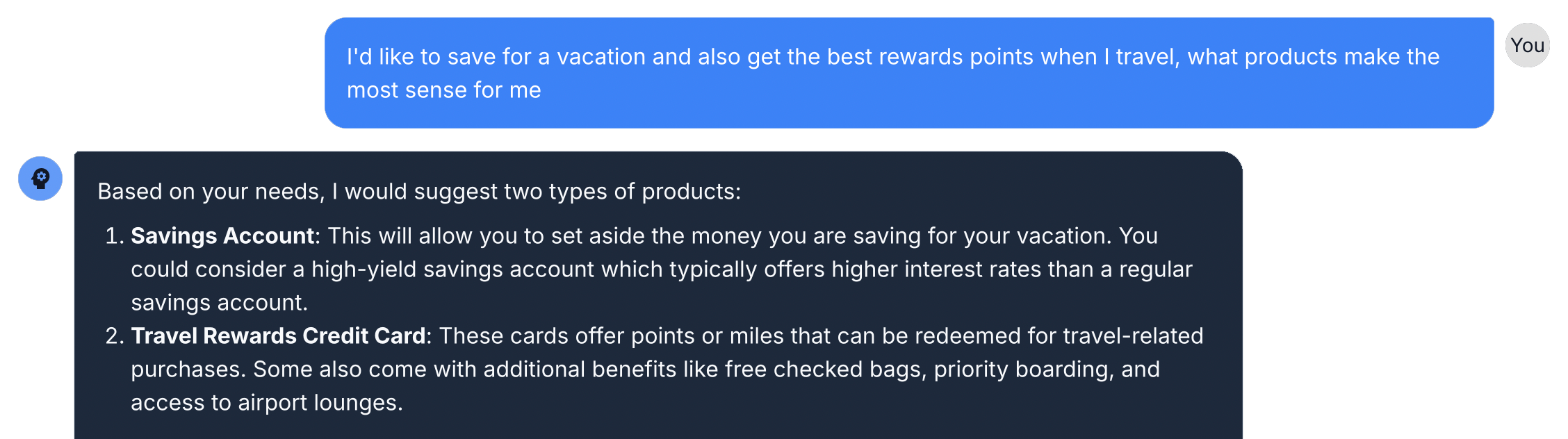

KAIgentic connects to real account data, transaction history, and financial goals. It turns every question into a contextual, compliant, and actionable answer just like a trusted banker would.

When a customer asks “Can I afford that holiday” KAIgentic instantly analyzes spending patterns, upcoming bills, savings trajectory, and past travel expenses. The result is advice they can act on immediately.

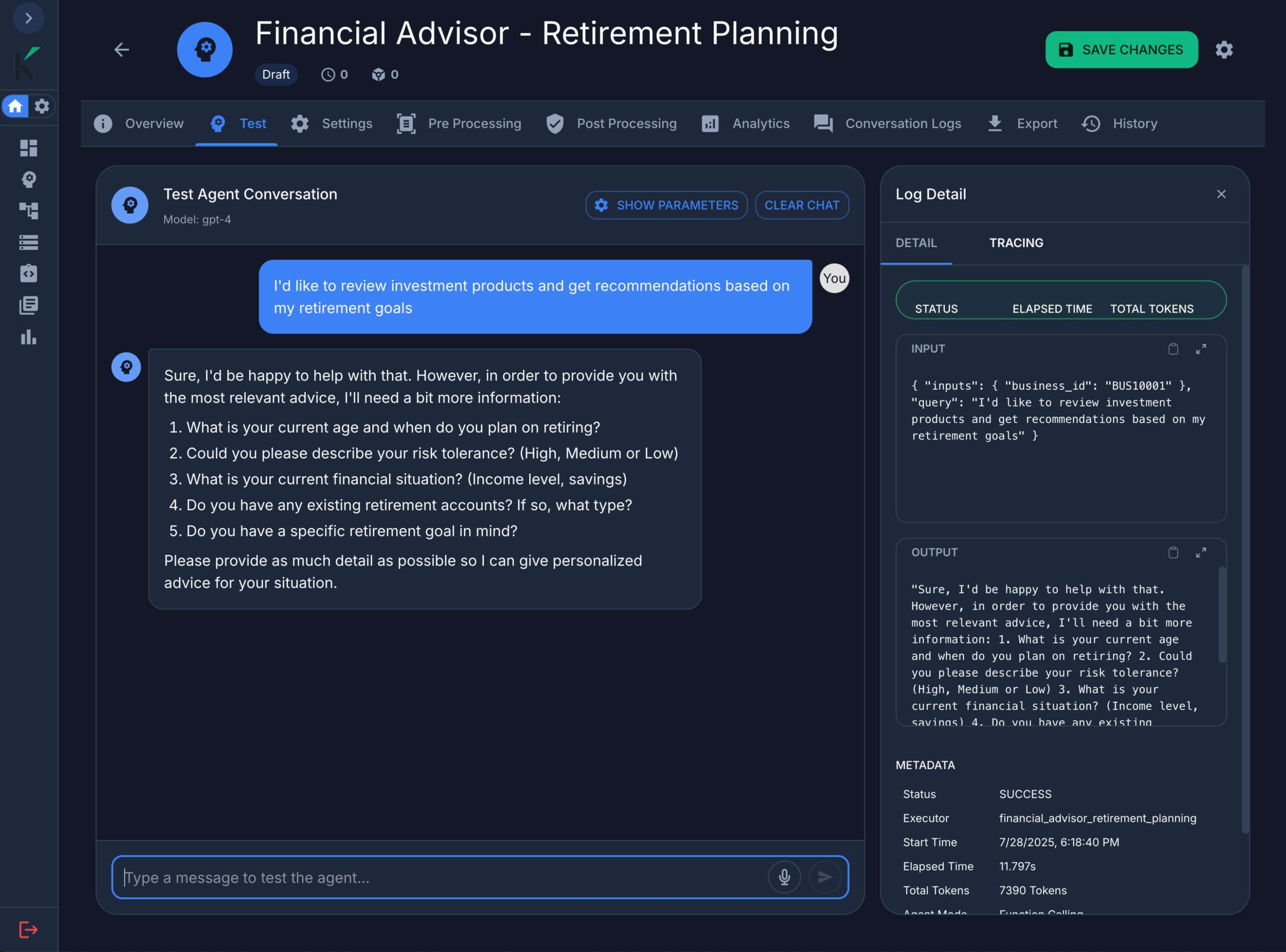

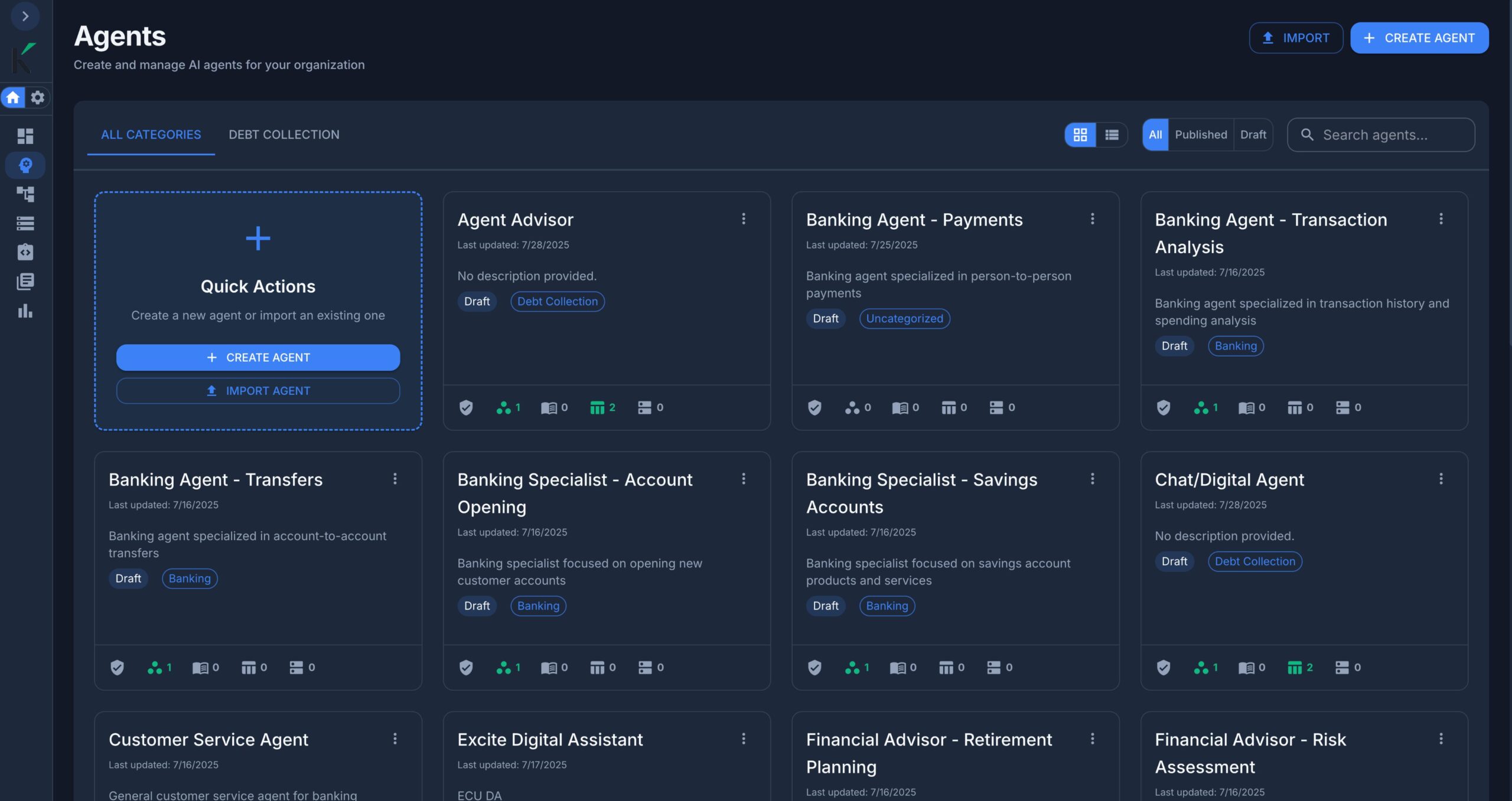

With KAIgentic, you can create and customize your own agents to address unique workflows or specialized customer interactions. Tailor their purpose, boundaries, and data access—while maintaining full compliance and oversight.

All agents operate together within your governance framework ensuring that every action is safe, compliant, and measurable.

Built for regulated environments with governance, privacy, and security embedded from day one.

Before: Responses shaped by your SOPs, regulatory rules, and permissions.

After: Secondary review agents filter for policy breaches, hallucinations, and errors.

Every output is grounded in real-time APIs and banking-tuned language models.

Every action is logged, traceable, and explainable providing immediate audit readiness.

KAIgentic is ready for the most demanding high trust banking scenarios.

24/7 Personal AI Banking Assistant

Always available across voice and digital channels.Contact Center Light

Boost agent productivity with instant summaries, eligibility checks, and compliant recommendations.Automated Compliance Monitoring

Continuous oversight that aligns with institutional policy.Internal Productivity Agents

Speed up work for relationship managers, underwriters, and service teams.