Our Products

Explore our suite of solutions personalized for your community bank or credit union.

Let Kasisto help you lead into the horizon by uncovering the best path to a generative AI-backed, future-ready position in the FinTech market.

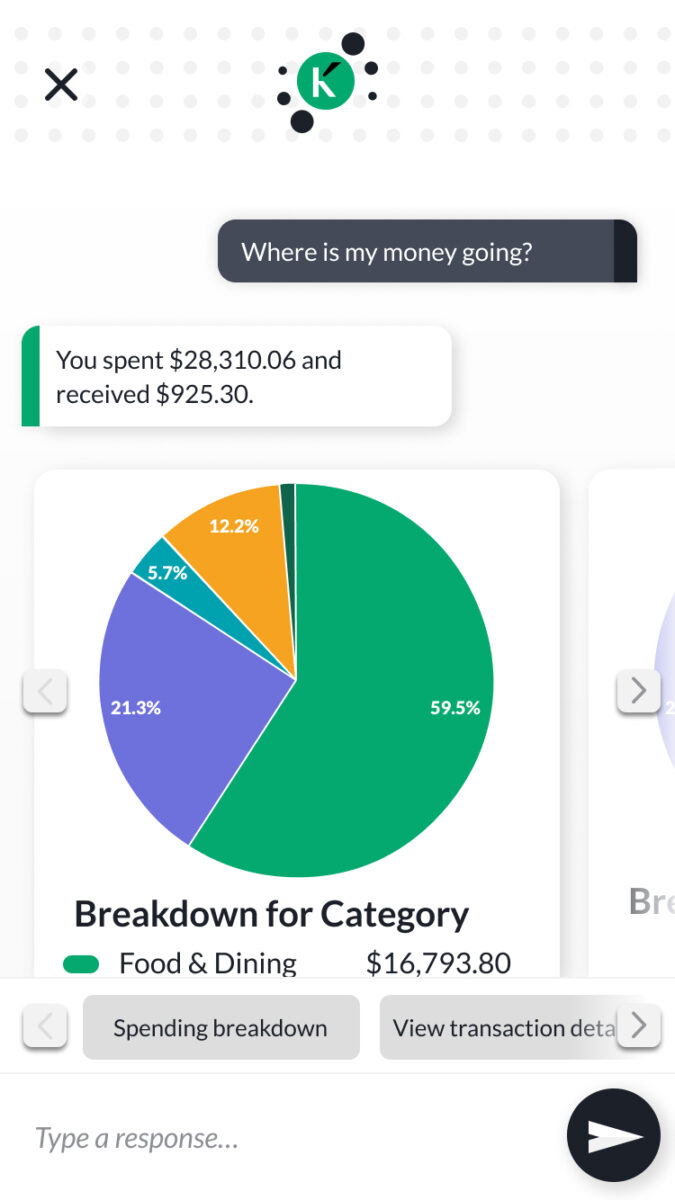

Customers want smarter conversations. Banks need better solutions. Here’s why AI purpose-built for banking is delivering both. Over the past…

In today’s fast-paced world, we believe that banking should be more than just a transaction—it should be tailored to you…

Banking has always been about trust. For centuries, people have walked into physical branches, shaken hands with their bankers, and…

New York, New York — Kasisto, the leader in AI built for banking, today announced the appointment of Robert Dugdale as…

Visionary AI Leader to Drive Innovation, Trust, and Reliability in Conversational AI for Tier 1 and Regional Banks January 7,…

Berks Selected to Lead Company in its Next Growth Phase New York, NY, October 23, 2024 – Kasisto, creators of…

Strengthening Position as the Leading Provider of Conversational and Generative AI Solutions for Financial Services New York, NY, September 17,…

We are excited to share that Kasisto has been awarded the Tech of the Future – Customer Engagement award at…

Explore our suite of solutions personalized for your community bank or credit union.