KAIops™ Operational Intelligence for Banking Powered by KAIgentic

KAIops strengthens the operational backbone of banking.

It brings intelligent automation to incident management, identifying root causes, executing governed remediations, and preventing critical failures before they damage trust or invite risk.

The Challenge

When a critical outage occurs, the entire institution feels the impact. Systems go down, customers lose confidence, and regulators demand answers. Banks spend weeks reconstructing the sequence of events, writing root cause analyses, and explaining how such a failure occurred. The cost in time, resources, and reputation is extraordinary.

Traditional monitoring and automation tools were never designed for the complexity of modern banking systems. They react after the damage has occurred.

KAIops was built to change that.

KAIops Architecture

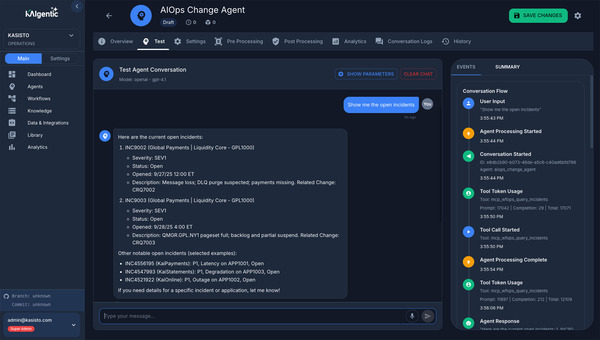

KAIops introduces an intelligent operational layer built on Kasisto’s KAIgentic platform. It learns from the past, acts in the present, and anticipates what may go wrong in the future.

Through a coordinated network of AI agents, it continuously monitors system health, correlates telemetry, drafts RCA narratives, and executes approved actions within strict governance frameworks.

The progression begins with intelligence augmentation, where AI agents analyze logs, metrics, traces, and tickets to surface probable root causes and recommended actions in real time. It advances to autonomous response, where trusted agents perform approved remediations such as restarting services, clearing cache, or scaling resources with human oversight and full audit trails.

It culminates in predictive prevention, where agents assess dependencies, evaluate planned changes, and forecast potential risk before impact occurs.

The result is a self-learning, self-healing operational fabric that allows banks to move from detection to prevention with accuracy, transparency, and control.

Governance and Control

KAIops was engineered for the standards of trust, auditability, and compliance required in banking. Every action is traceable, every decision is governed, and every execution is reversible. It operates with role-based approvals, read-only modes, and human validation where necessary.

All activities are logged and integrated with existing change management and governance systems. This ensures that AI-driven decisions remain transparent, explainable, and accountable.

Business Impact

KAIops enables banks to reduce the cost and duration of incident resolution while preventing future outages. It delivers measurable improvements in mean time to resolution, incident recurrence, and customer impact minutes.

By embedding predictive intelligence into IT operations, institutions achieve:

- Operational Stability

- Faster RCA Completion

- Significant Reductions in Regulatory and Reputational Risk

Contact Us

Why Kasisto

- Kasisto is the market leader in agentic AI purpose built for banking. Our KAIgentic platform delivers intelligent, compliant, and auditable AI experiences trusted by financial institutions around the world.

- KAIops extends this foundation into IT operations, bringing the same precision, reliability, and governance that define Kasisto’s leadership in banking technology.

Experience how KAIops can strengthen your operational resilience and reduce incident cost while preserving the trust your institution is built on.