Business Banking Knowledge

Your business customers need a smart assistant fully equipped to support complex requests and guide critical financial decisions.

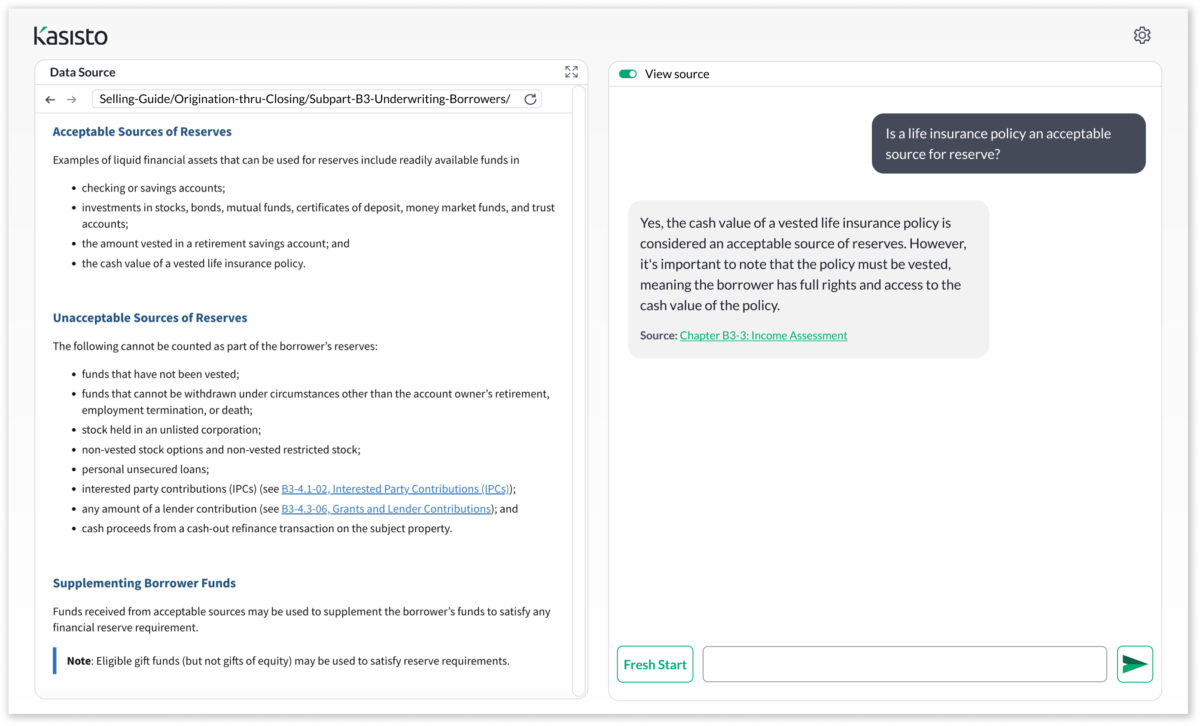

KAI is trained to provide the specialized care businesses require through immediate access to precise information, services, and products, like cash positions and cash flow, payments and wires, and aggregate holdings and liabilities.

Investment Management Expertise

Consumers want a trustworthy expert to support their most valuable and precious possession, their future.

KAI provides future-focused consumers with the knowledge they need to become savvy investors and enjoy more informed collaboration with their financial advisors.