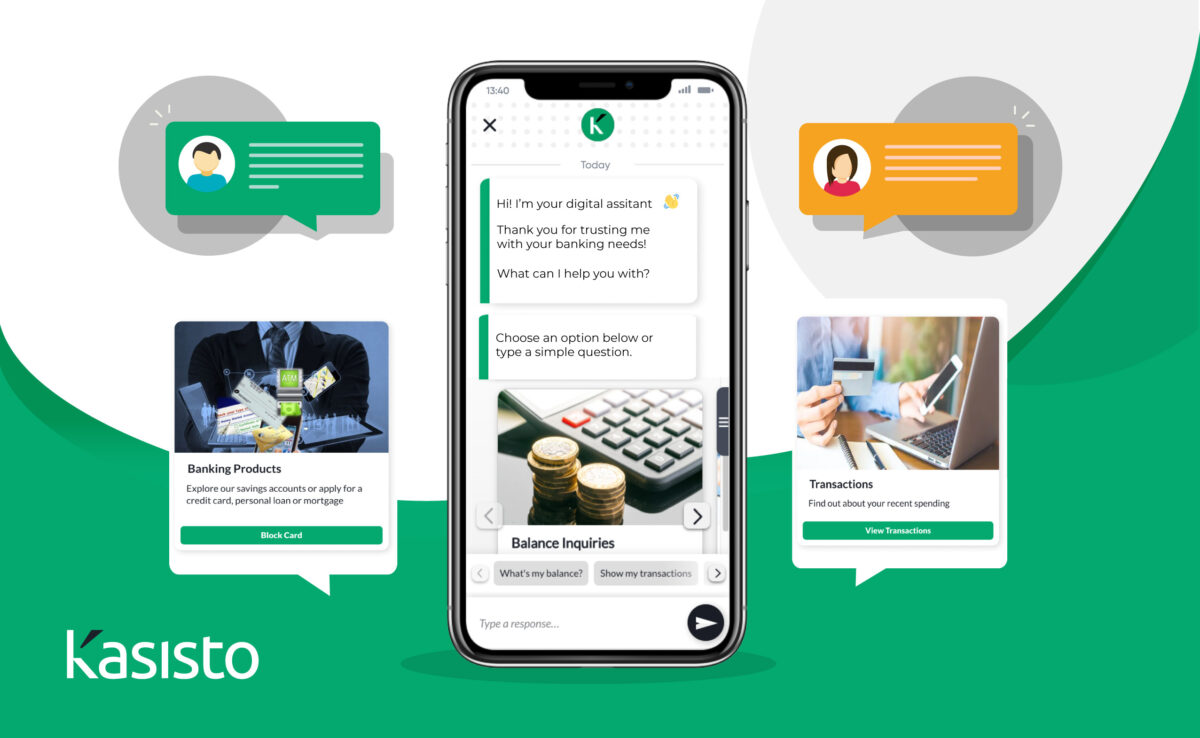

You may already have marketing associates on your team, but have you ever considered “hiring” an intelligent digital assistant? Also known as “IDAs,” these digital marketing teammates use conversational AI and natural language understanding to address complex customer queries and provide a highly personalized and intuitive digital experience.

Intelligent digital assistants take the concept of a chatbot to the next level by adding personalized, growth-oriented, and relationship-focused conversations to the tried and true formula of digital customer support.

Marketing Department Woes

The important role that a marketing department plays in the development and overall growth of a financial institution cannot be overstated. Customers have thousands of financial institutions to choose from, and it’s the marketing team’s job to elevate your financial institution above the competition.

As the landscape of digital banking continues to change, new and unexpected challenges have arisen. Many marketing departments can feel overwhelmed with the sheer number of mounting tasks they need to complete on a daily basis – they have to craft a clear brand voice and value proposition while finding ways to differentiate amid the sea of banking options, and adjusting marketing strategies on the go as the industry shifts.

Humans can only work at a certain pace before burning out or making mistakes. Digital experience technology, like digital assistants and other conversational AI solutions, provides valuable, accurate, round-the-clock support for your marketing team.

3 Ways an IDA Improves Your Marketing Strategy

Your financial institution needs a digital experience solution that integrates with your existing systems and processes, and can be accessed by employees and customers across channels. An IDA offers just that. It is a customizable, customer-facing, humanized AI solution that can be branded and delivered as a part of a holistic digital banking experience. The information it collects and the conversations it orchestrates can then be used to augment your marketing team’s efforts.

Here are three ways an intelligent digital assistant can improve and elevate your financial institution’s marketing strategy.

Support Your Brand Voice

When you pair a personalized IDA with your marketing efforts, you can boost your brand voice and increase brand awareness in your market.

IDAs can have entire personalities built around them that mirror your financial institution’s tone and the image you want to convey. By infusing your customer-facing assistant with human patterns of speech, a bit of personality, or even a physical appearance, you go far beyond delivering a service bot to create a “virtual best banker,” someone who your marketing team can use as a brand ambassador.

This IDA is a solution that customers interact with and one that embodies the core messaging of your financial institution.

In the Real World: How Rita Embodies BankSouth’s Brand Voice

One of our clients, BankSouth, implemented an IDA named “Rita” across its customer community. Launched in only a month using a base set of a few hundred questions or “intents” from Kasisto, Rita was given a sassy and smart personality that reflects the bank’s own brand voice. She can answer a multitude of questions, and she shares relevant financial knowledge based on each customer’s personal financial journey, all while retaining the unique face and brand voice of BankSouth.

Create Differentiation

Today’s banking consumer has a massive number of options to choose from – in 2021, there were 4,236 FDIC-insured commercial banks in the United States, not including the nearly 250 virtual-only, or “challenger” banks in the industry. Add mobile payment applications like Venmo and CashApp to the mix and your average consumer is inundated with financial marketing messages.

These days, your marketing team must roll out new initiatives faster than ever to effectively differentiate your financial institution from the competition. Utilizing an IDA to elevate your customers’ digital experiences via real-time, conversational AI-driven dialogue is something that few banks have implemented yet. As of early 2020, only 13% of banks and credit unions had a chatbot, and another 16% were planning to introduce one in 2021, according to Cornerstone Advisors.

Customer engagement is the key to differentiation and customers expect their financial institution to give them options for frictionless self-service. Take this opportunity to make an IDA an important part of your bank’s digital direction and marketing strategy by promoting its benefits.

In the Real World: How Rita Differentiates BankSouth From the Competition

Rita is embedded throughout BankSouth’s entire digital experience, and customers can engage with her over multiple channels, including the online banking program or BankSouth’s mobile app. She helps differentiate BankSouth by offering a convenient and always-available customer relationship model, coupled with a human-like personality. She appears in their bank, on the website, in advertisements, and in email. She also engages and informs customers, guiding them through workflows like new account applications, which gives BankSouth a distinct advantage over its competitors with lower abandonment rates and higher new account conversions.

Provide Analytics

Think of an IDA as a chatbot with a Ph.D. in banking. It’s preloaded with financial knowledge and continues to learn and adapt over time. Utilizing an IDA gives you a feedback loop of valuable insights and analytics into how your customers interact with your brand, how successfully their issues are resolved, and more.

And this strategy continues to adapt and evolve to your customers’ needs over time, giving you useful information about what they want to learn more about and which of your promotions are performing. This data can then inform your marketing strategy, including the content you develop, the audiences you target, and the messages you communicate.

In The Real World: Data to Inform and Develop

Within the first three weeks of deployment, BankSouth received positive feedback from both employees and customers. Customers love that they get responses at any time of the day, any day of the week, and employees like that Rita handles a lot of the up-front customer queries. She helped significantly increase customer digital adoption by over 20%, which has made BankSouth’s marketing department’s job easier by attracting and retaining new customers.

A Holistic Approach

It’s important to note that while your digital marketing efforts should be one of your primary focus areas, you can’t afford to neglect the other areas of marketing.

Community banks and credit unions must deliver exceptional in-person banking experiences to maintain strong relationships with customers and members. A personalized digital assistant, while primarily existing in the digital space, can have a real-world impact on your entire brand, which includes marketing and communication strategies in branches and across all of your products and services.

Your IDA can represent your entire brand by appearing on in-person signage, and informing the language your team members use when speaking to customers. It can even be used to help train your team.

BankSouth utilized every channel to roll out a full-blown marketing campaign introducing Rita as an extension of the bank’s customer care team, from email, social media, newspaper ads, physical branch collateral, and automated phone messages. Within the first three weeks of Rita’s deployment, BankSouth received positive feedback from both employees and customers who appreciated the multi-pronged launch of the intelligent digital assistant.

Interested in Building Your Virtual Best Banker?

Check out how we deliver fast, effective implementation of your unique personalized digital assistant in under 30 business days. Doubting the fast deployment timeline? Hear BankSouth discuss its partnership with Kasisto and NCR in which they implemented Rita in under six weeks, resulting in a 96% containment rate and a 2x average customer engagement rate.