AI Agents

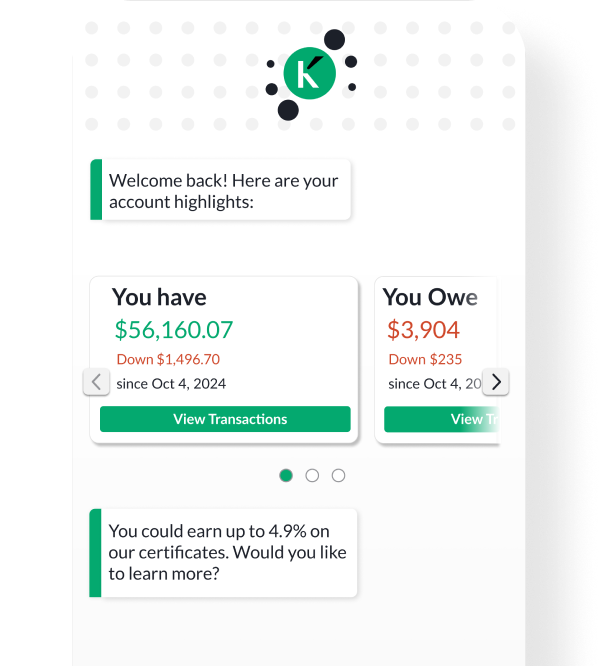

Customized and branded to engage your market, KAI Consumer Banking is the banking AI Agent for retail banking that creates a friction-free, personalized customer experience by combining AI and human-like assistance.

KAI Consumer Banking comes ready with everything you need to humanize, maintain, and develop your AI Agent and focus on the specific banking needs of your unique market.

Your Best Virtual Banker

Create a unique personality that aligns with your financial institution’s brand and delivers the expertise of your best bankers.

KAI Consumer Banking acts as an invaluable extension of your banking team.

It is pre-integrated with your digital banking solutions to provide accurate, up-to-the-minute financial data and, when needed, seamlessly transition conversations to human team members through live chat technology.

Pre-Packaged Banking Knowledge

Deep financial expertise eliminates the need for costly ramp-up time and training.

Integrated Digital Experience

When implemented with your digital banking provider, the assistant delivers accurate and up-to-date financial information across multiple channels.

Seamless Live Agent Handoff

For any query the AI Agent can’t handle, it passes it off to a live agent and then picks up the chat thread once that interaction is complete.

Omnichannel Service

Websites, mobile apps, and even email, phone, and physical personifications serve as conduits for introducing the AI Agent to customers and members.

Multilingual Solutions & End-to-End Spanish Support

KAI is deployed in 16 countries, supporting banking consumers in a wide variety of languages. For financial institutions that serve Spanish-speaking markets, KAI comes complete with a full-service conversational Spanish solution.

What Can KAI Consumer Banking Do?

Built on the KAI platform, KAI Consumer Banking equips you to deliver humanizing digital experiences that support customers’ financial well-being and set your consumer banking business up for success.

KAI Consumer Banking covers the entire digital financial journey — from simple support questions to long-term strategic planning. Below are a few ways the banking AI Agent helps your financial institution serve customers, increase engagement, and drive growth.

Serve Customers

- Greet customers and members with intelligent, relevant messages delivered by your digital brand ambassador

- Block, replace or increase the limit of a credit card

- Check on the status of a card or loan application

- Search for transactions and spending

- Augment and support contact center inquiries

Increase Engagement

- Set financial well-being goals and get spending alerts

- Break down spending patterns

- Notify when bills are due, or a balance is low

- Pass along contextual merchant offers and rewards benefits

- Deliver targeted, visual experiences based on usage history

Drive Growth

- Deliver your brand in every interaction via a consistent, curated experience

- Upgrade a basic savings account to a higher-yield account

- Apply for a new credit card, debit card, or loan

- Purchase additional products, such as travel insurance

- Enroll in a promotion or campaign

KAI Consumer Banking with KAI Answers

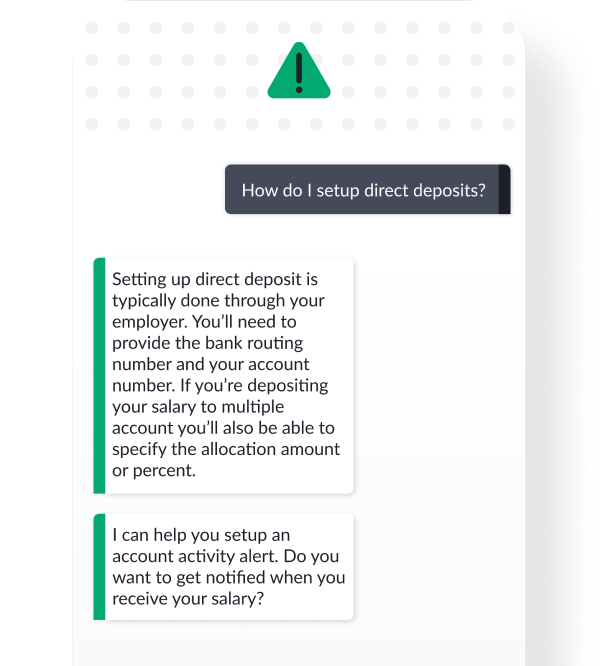

Financial Institutions are empowered to leverage the power of LLMs, like KAI-GPT, to enable their consumer-facing virtual assistant to produce generative replies based on any internal and/or public-facing document ingested via the KAI Portal.

Key Benefits

- Decrease Call Volumes: Improve containment rates and increase cost savings.

- Extend On-Demand AI Agent Coverage: Deliver improved customer experiences with responses based on time-sensitive, localized, rapidly changing bank-specific content.

- Minimize Administration Costs: Simplify system maintenance with no model retraining, intent development, or advanced skills needed.

Your Best Virtual Banker

Create a unique personality that aligns with your financial institution’s brand and delivers the expertise of your best bankers.

KAI Consumer Banking acts as an invaluable extension of your banking team.

It is pre-integrated with your digital banking solutions to provide accurate, up-to-the-minute financial data and, when needed, seamlessly transition conversations to human team members through live chat technology.

Differentiated Customer Experience

- Proven containment (~over 200 intents OOTB)

- Expanded coverage powered by generative AI

- Rich conversational experiences powered by integrations (account, transactions, wellness)

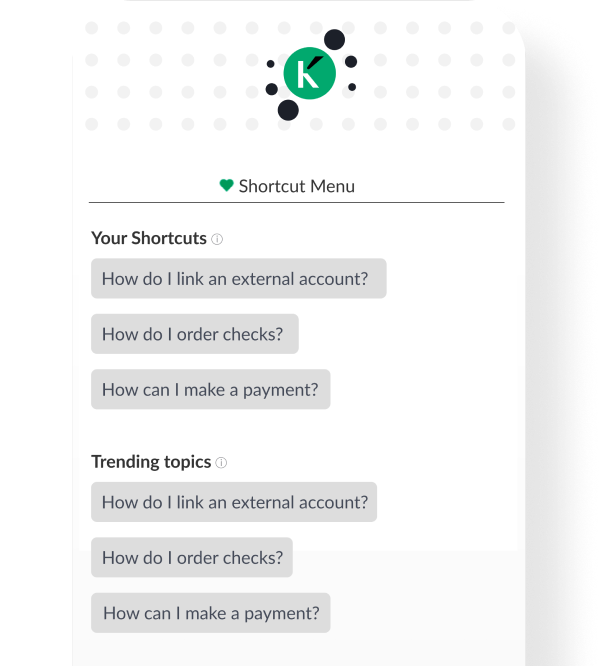

- Maximized user engagement & discoverability infused with generative AI (autocomplete, conversational follow ups)

- Personalized UX (conversation memory, shortcuts, conversation starters)

Enterprise-grade Administration Tools

- Usage analytics & insights

- Content Management

- Publishing flows & audit trails

- Document Management

- Web crawler

- Coverage discovery service

Robust Accelerators to Go Live

- Pre-integrated with user financial data

- UI SDK optimized for web & mobile CX

- Live chat adapters & API (Glia, LinkLive)

- Omnichannel support via CAPI

- Multi-language support spanish