Who We Serve

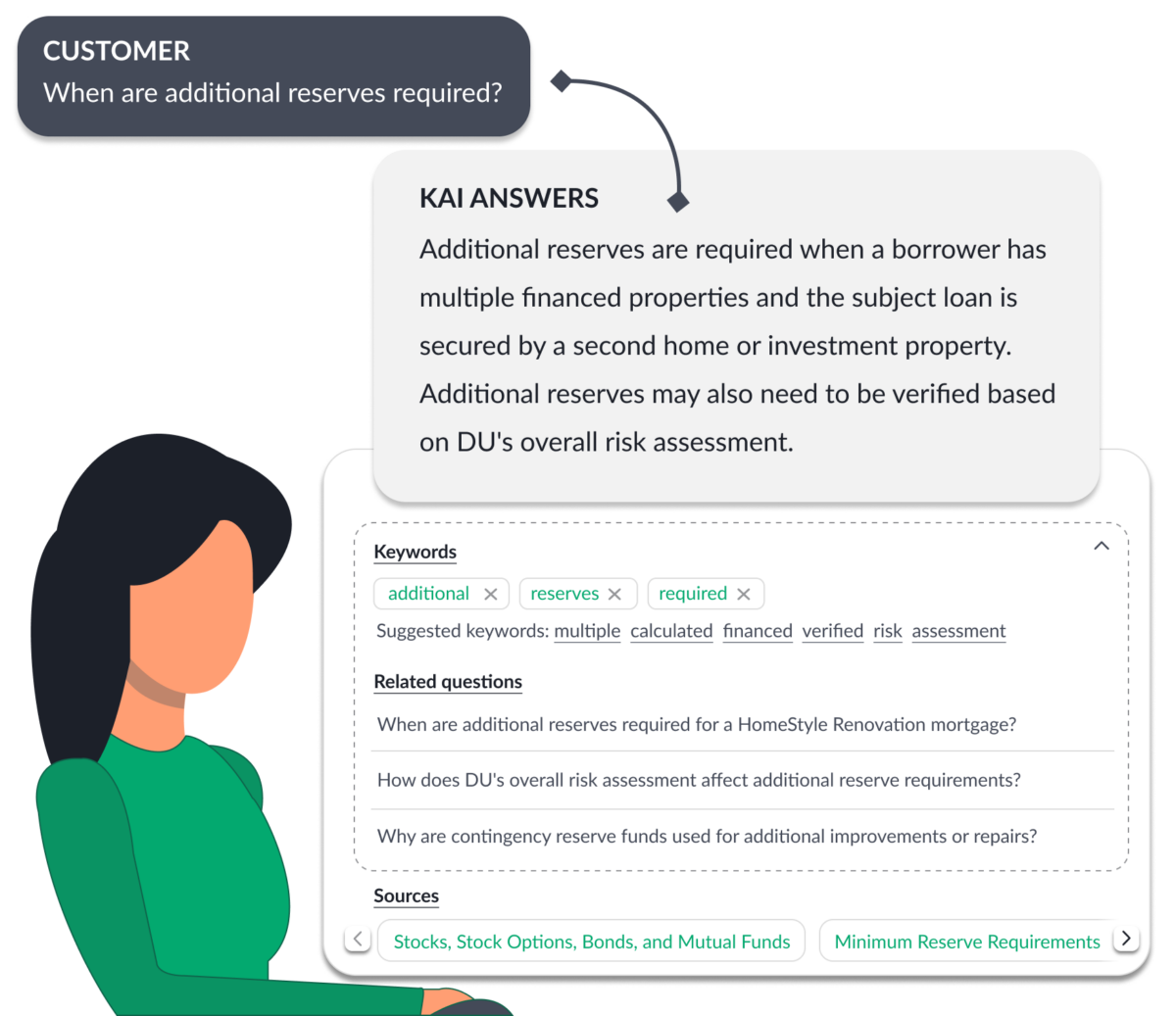

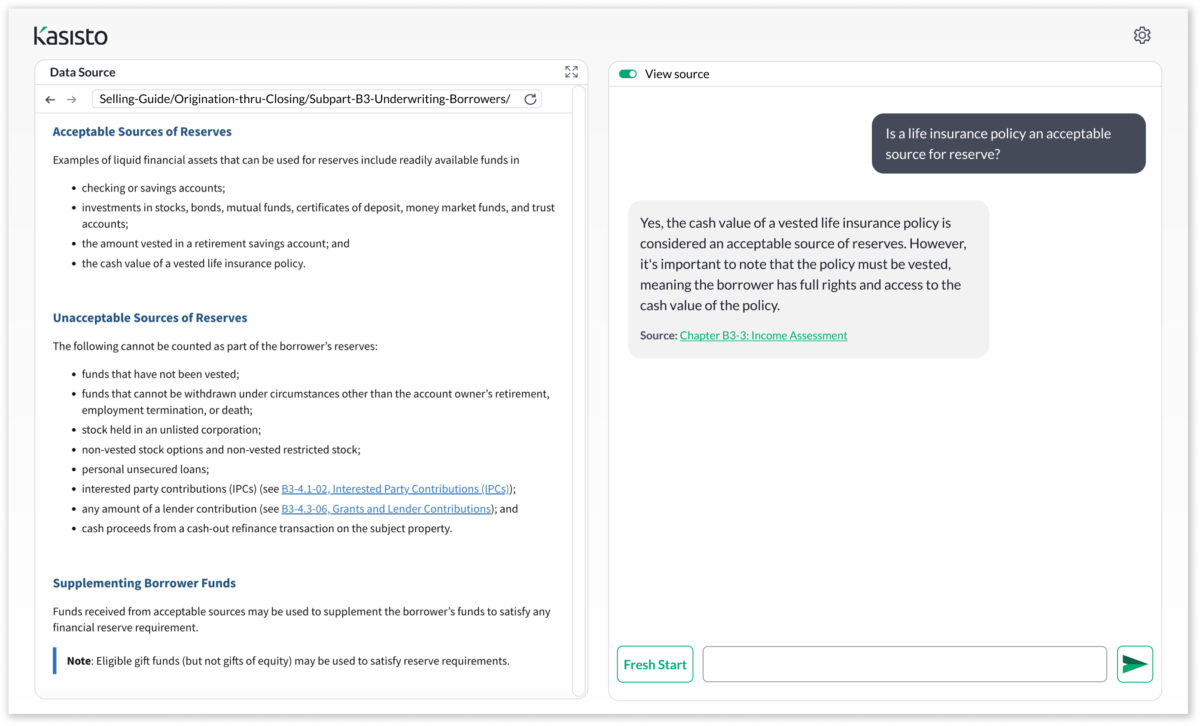

KAI makes it possible for financial institutions of all sizes to automate amazing banking experiences. Kasisto works with global and regional financial institutions, community banks, and credit unions to create precise, personalized interactions that drive growth.