The Future of Banking Runs on Agentic AI

Move beyond conversations — to intelligent action, predictive engagement, and trusted compliance with KAIgentic AI.

Built for banking. Trusted by leaders.

-

Purpose-built for financial institutions

-

Zero-hallucination platform

-

Trusted compliance and security

-

Proven revenue growth and cost reduction

Trusted by leading financial institutions

Why Kasisto? Banking is at a turning point.

AI isn’t just changing customer expectations — it’s redefining survival. Kasisto delivers the next evolution: Agentic AI that blends the predictability of your compliance systems with the intelligence and proactivity today’s customers demand.

While others sell automation, we empower your organization to:

-

Win trust in a digital-first world

-

Grow revenue with personalized, predictive customer journeys

-

Slash operational costs through intelligent action, not just conversation

-

Future-proof your institution against the next wave of AI disruption

Kasisto is your bridge:

-

From legacy compliance to intelligent adaptation

-

From reactive support to proactive financial empowerment

-

From transactional banking to relationship-driven growth

Business Value for Banks

Predictive Engagement

Anticipate customer needs before they even reach out.

-

Increase containment rates

-

Decrease abandonment

-

Strengthen customer trust

of questions are answered by KAI

Personalized Experiences

Tailor every interaction with user behavior, history, and preferences.

-

Boost CSAT and NPS

-

Deepen engagement

-

Increase loyalty and lifetime value

increase in digital engagement

Proactive AI Outreach

Engage customers proactively to turn service interactions into growth opportunities.

-

Reduce inbound volume

-

Create new revenue streams

consumers with access to KAI

What Makes Kasisto Different

KAIgentics: Behavioral Personalization at Scale

Kasisto’s proprietary behavioral engine refines personalization in real time, built on years of real banking behaviors.

- Enhances engagement based on real financial behavior patterns

- Orchestrates multiple specialized AI agents seamlessly

- Adapts based on evolving customer profiles

- Always regulatory-compliant and secure

Result: Smarter, safer, more human banking experiences — at scale.

Multi-Agentic AI

Specialized AI agents working collaboratively to achieve intelligent outcomes:

- Parallel Processing: Specialized agents execute faster and more accurately

- Collaborative Output: Multi-agent coordination avoids hallucinations

- Sophisticated Logic: Handles complex, multi-step workflows autonomously

Result: Faster decisions, lower costs, higher customer satisfaction.

Transforming the Future of Customer and Employee Experiences with Trusted AI

Innovative Customer Experiences

Fulfill customer needs through engaging conversational experiences leveraging Prescriptive & Generative AI

Empowering Your Employees

Get instant, accurate answers using your institution’s knowledge base and the power of Generative AI

Kasisto’s products drive measurable business outcomes while meeting the requirements for reliability, compliance, and risk.

Generative AI is Here

Introducing KAI-GPT, the financial industry’s most authoritative large language model. Combining our proprietary KAI large language model with the latest GPT technology, KAI-GPT is generative AI for the modern banking provider.

Explore Kasisto’s many use cases

Customer Assist

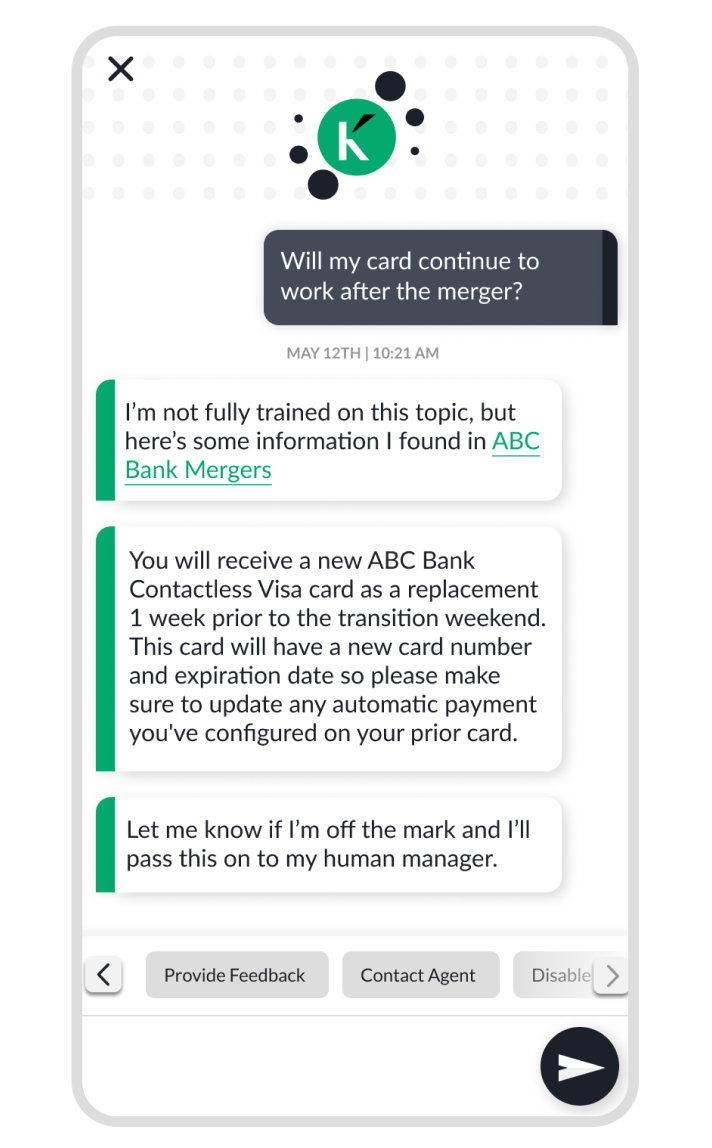

Financial institutions often experience significant spikes in customer support requests and inbound calls during major transition events like mergers, system upgrades, or conversions.

Kasisto’s AI Agent with KAI Answers empowers financial institutions to handle these increased demands by leveraging prescriptive and generative AI-powered Agents ensuring consistent and efficient customer support.

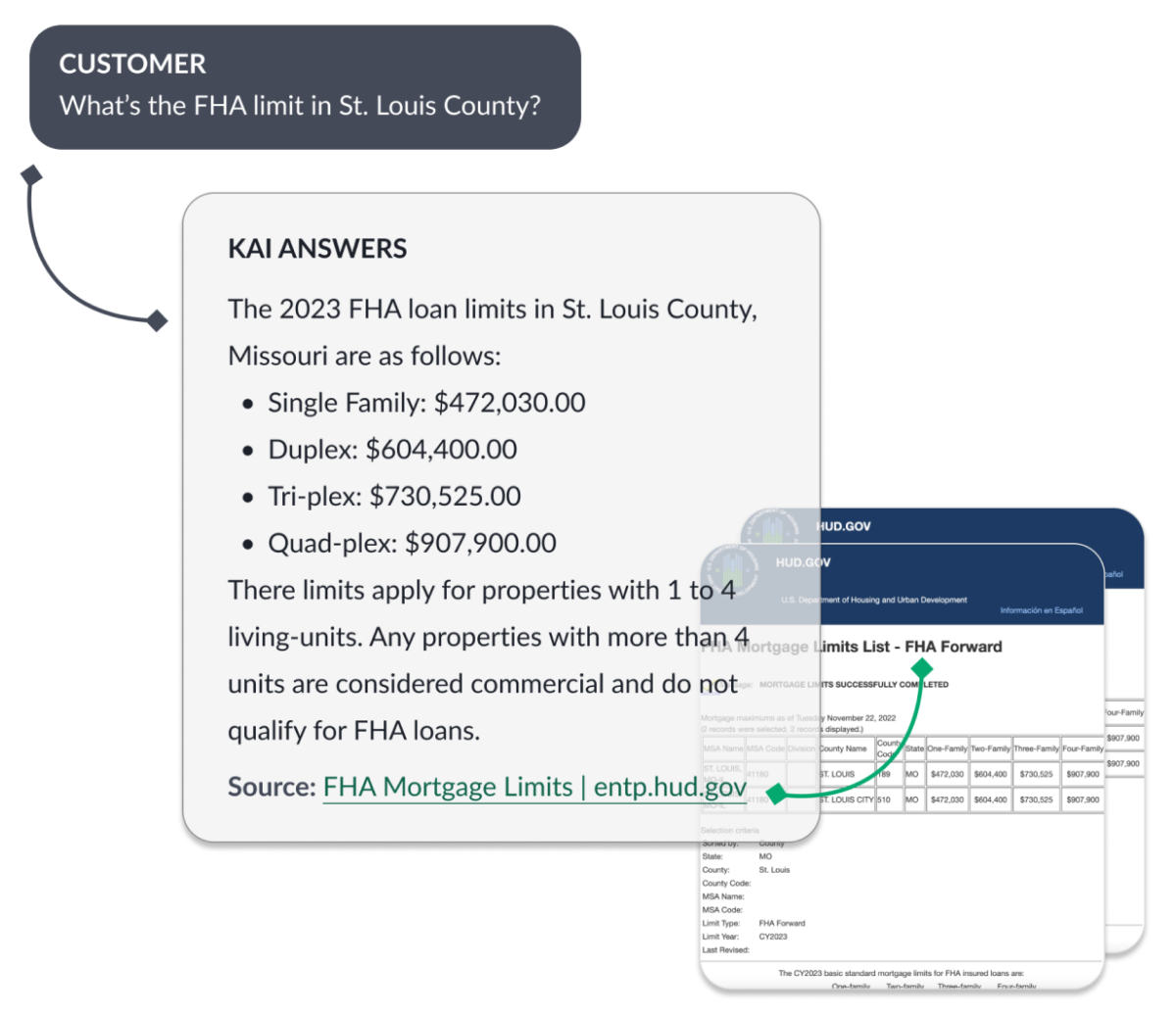

Agent Assist

When information is difficult to access, it leads to longer agent response times and slower resolutions to customer inquiries. This not only frustrates employees but also diminishes the overall customer service experience.

KAI Answers provides agents instant access to the information they need, significantly reducing onboarding time and boosting confidence in customer interactions. Empowering agents with quick, accurate answers enhances job satisfaction and improves overall service efficiency.

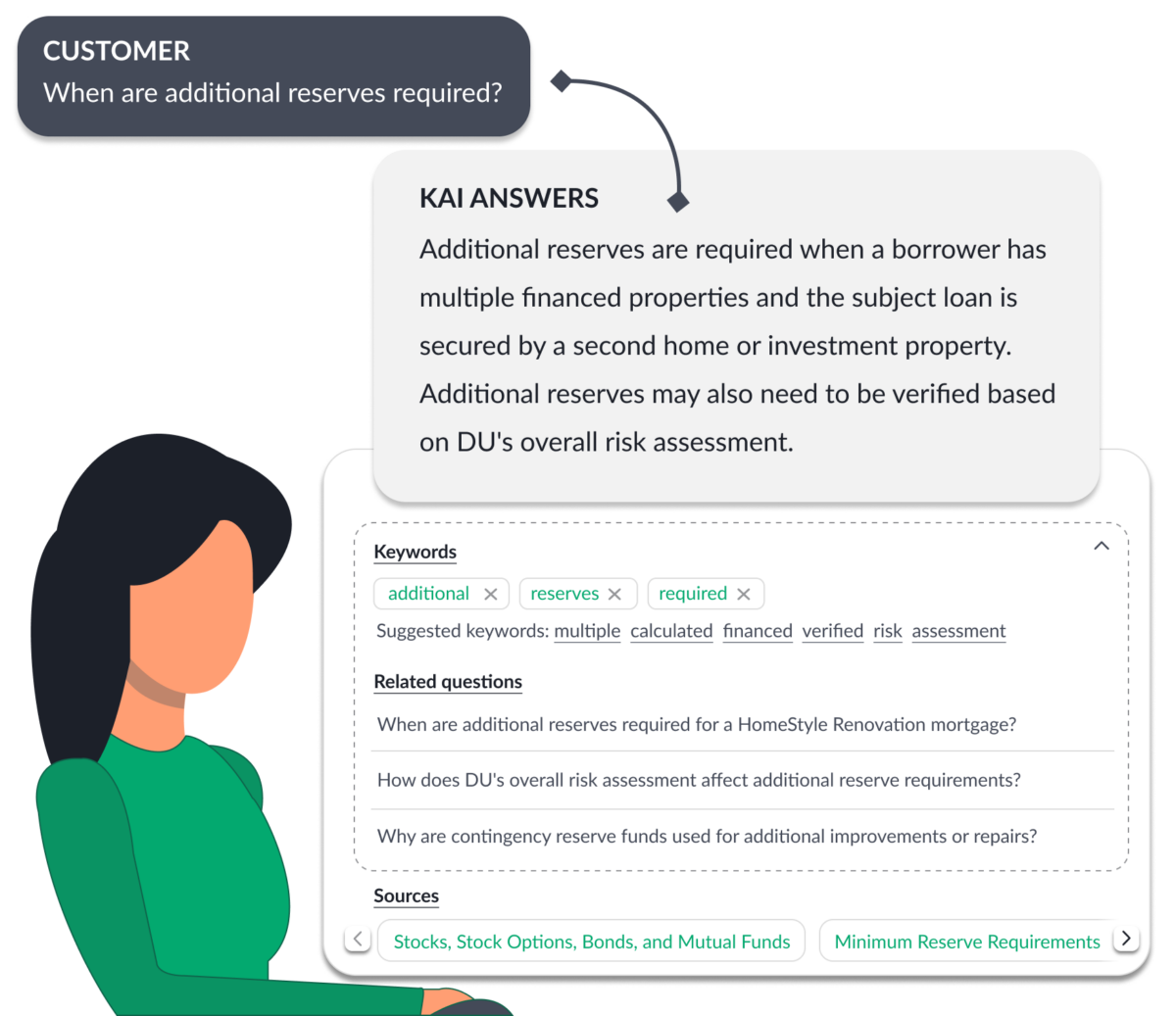

Employee Assist

Employees often face inefficiencies as they search through multiple knowledge repositories or consult colleagues. This results in delays in process and increased back-and-forth with customers.

KAI Answers integrates seamlessly with the financial institution’s knowledge repositories, providing employees with direct, referenceable answers to questions and quick access to relevant documents and policies. This streamlined access reduces the number of interactions needed , improves efficiency and overall service quality.

Kasisto Makes Integration Easy

Our Partners

FinTech partners who work with Kasisto stay on the leading edge. Integrating with KAI gives you access to the financial industry’s most powerful combination of generative AI, conversational capabilities, and comprehensive financial knowledge.

A partnership with Kasisto is an optimal way to supercharge your solution and make your offering and your brand even more attractive to customers, industry influencers, and investors.